Quick shot: How recent U.S. tariff policy could affect portfolios

Global Investment Strategist

The barrage of U.S. tariff announcements over the past week, along with subsequent retaliatory measures from affected trade partners (China, Mexico and Canada) have soured global risk sentiment. Equity markets from the U.S. to Europe to Asia have seen increased volatility as trade policy uncertainty becomes reality. The new tariffs bring the average effective tariff rate imposed by the U.S. on trading partners to the highest level since World War II. In particular, the average effective tariff rate on imports from China has increased to 34% from roughly 14% at the start of the year. The biggest impact of the tariffs, especially those imposed on Mexico and Canada (25% on all imports with a 10% carve out for Canada energy imports), will likely be how long they are in effect. The longer they remain in place, the larger the potential impact on growth (lower) and inflation (higher). For now, we expect a more moderate impact on the U.S. and a larger negative impact on the economies of Mexico and Canada.

In terms of Federal Reserve (Fed) policy, we do not anticipate that the Fed will make any immediate adjustments. They are likely to employ a wait and see approach to ensure that any moves lower in policy rates don’t offset any potential growth or reignite inflation.

Work with an advisor

Our advisors can provide ongoing financial advice on how your portfolio can adapt to the changes in the market, your life and your goals.

It’s clear that the headlines will continue to evolve quickly and that volatility is likely to remain elevated. Here are two important considerations:

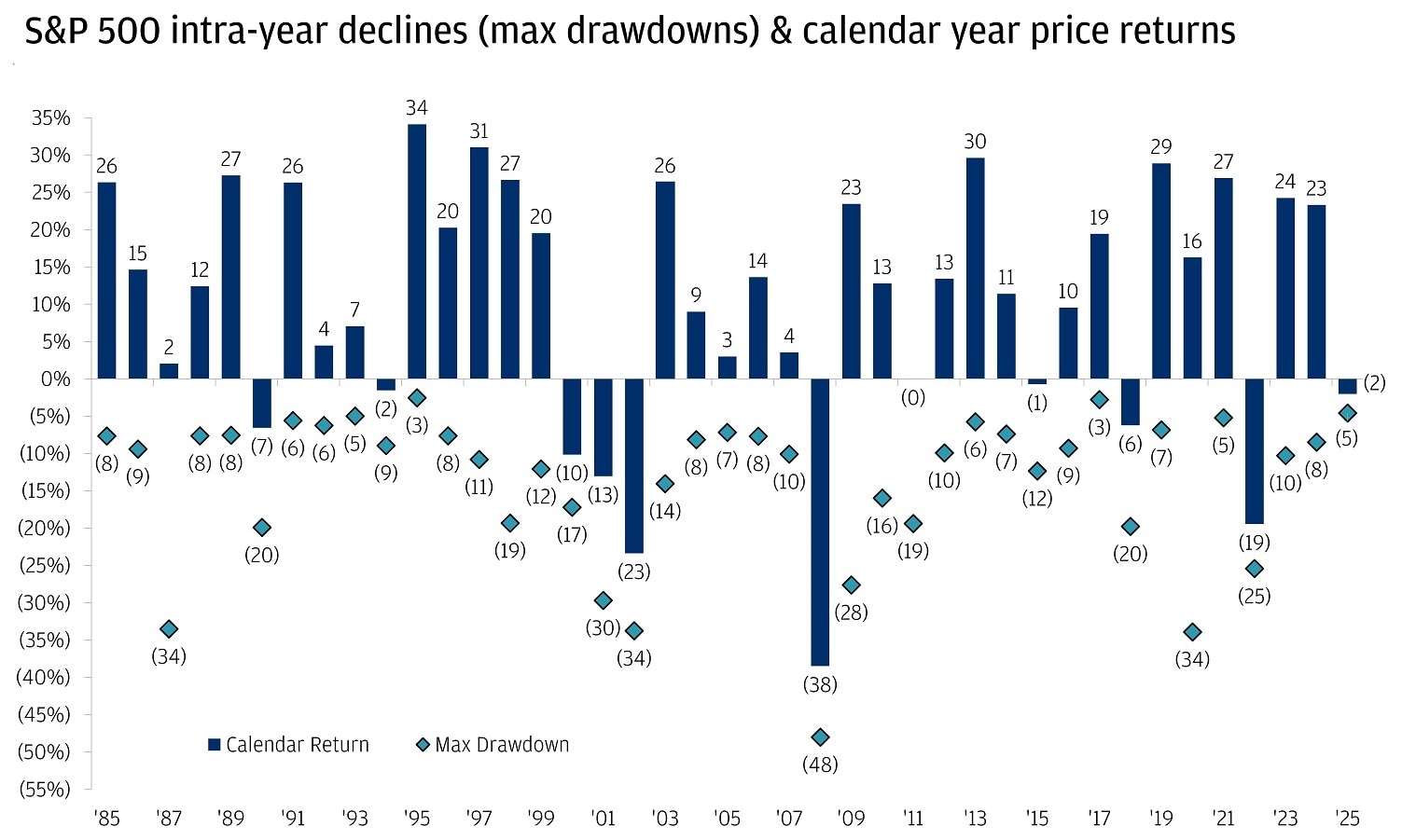

- First, volatility is a normal side effect of investing.

- Second, uncertainty is a good reminder to re-examine existing portfolio allocations.

A well-diversified portfolio, incorporating a geographic mix of equities, can help capture global returns during periods of strong economic growth. Meanwhile, bonds can play a vital role by providing a steady stream of income and serving as a safeguard against growth slowdowns. We would also consider assets that may have a low correlation to both equities and bonds, such as gold. This balanced approach can enhance resilience during market volatility, helping to keep your investments aligned with your long-term financial objectives.

Despite intra-year swings, equities tend to reward investors over time

All market and economic data as of 03/04/25 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Explore ways to invest

Take control of your finances with $0 commission online trades, intuitive investing tools and a range of advisor services.

Global Investment Strategist